Fear and Greed Index

Fear and greed are two of the most powerful emotions in financial markets. They can drive prices up or down and often dictate investor sentiment. But what are these concepts, exactly? And why do they have such a big impact on markets? This post will explore the fear and greed index and how it affects market movements. Some investors are getting rich quickly by riding the wave of crypto-mania, while others are gripped by fear

Where can fear and greed be applied?

Traditional markets are based on fear and greed. For example, when a company announces bad news, the stock price will often go down because investors fear the company will fail. Conversely, when a company announces good news, the stock price will often go up because investors are greedy for the company’s success. The same is true for whole industries and even entire economies. When there is fear in the markets, prices will usually go down, and when there is greed, prices will usually go up.

The relationship with the crypto market is similar in some ways but different in others. For example, traditional markets are based on government-issued fiat currencies, while crypto markets are based on decentralized digital assets. Traditional markets are also subject to regulations, while crypto markets are not. However, both traditional and crypto markets are driven by fear and greed. In traditional markets, investors may fear losing their money if a company goes bankrupt or an economy collapses. In crypto markets, investors may fear losing their money if a digital asset is hacked or stolen.

Similarly, in traditional markets, investors may be greedy for profits if a company does well, or the economy is booming. In crypto markets, investors may be greedy for profits if a digital asset rises in value. Ultimately, fear and greed are the two most powerful emotions in any market, traditional or otherwise.

How do these emotions drive investment decisions?

Traditional markets are driven by a variety of emotions, from fear and greed to hope and optimism. These emotions influence the decision to buy or sell a stock. In the world of cryptocurrencies the exact same thing is true, and controlling emotions plays a key role in the day-to-day life of the investor.

The volatile nature of the cryptocurrency market means that emotions can significantly influence prices. When there is market sentiment for a particular coin, it can drive prices up or down. Fear and greed are particularly powerful emotions in the cryptocurrency world, as they can cause sudden price changes. For example, fear of missing out (FOMO) can cause investors to buy coins at high prices, while greed can lead to selling when prices are low.

Traditional markets, on the other hand, are more stable. Emotional reactions tend to be less extreme. This is one of the reasons why traditional markets are often considered more efficient than the cryptocurrency market. Still and all, fear of a recession can cause investors to sell stocks quickly, while optimism about a company’s prospects can lead to hasty buying. Having objective information about general market sentiment can be an important investment advantage.

Ultimately, whether investing in traditional markets or cryptocurrencies, it is important to be aware of the role of emotions in the decision-making process.

How can investors overcome fear and greed to make rational investment choices?

Investing can be a tricky business. On the one hand, you want to make money and grow your wealth. On the other hand, you don’t want to take unnecessary risks that could lead to financial losses. This delicate balance can be especially difficult to achieve when traditional markets are volatile, as they have been in recent years. Many investors have turned to the crypto market in search of stability, only to find that it is just as prone to dramatic swings in value. So how can investors overcome fear and greed to make rational investment choices?

One key is to focus on market sentiment. This can be difficult when emotions are running high, but it’s important to remember that the market is made up of buying and selling individuals based on their own perception of what is happening. If you can stay calm and objective, you will be better able to make decisions based on data and analysis rather than emotion.

Another key is to diversify your portfolio. This means investing in various assets, including traditional stocks, bonds, and crypto assets. By spreading your risk across different asset classes, you can minimize the impact of any one market downturn.

It is important to remember that fear and greed are natural human emotions. It is impossible to eliminate them from your decision-making process completely. However, by being aware of their influence and taking steps to offset their impact, you can stay focused on your long-term goals and make rational investment choices.

Are there any strategies that can help investors manage their emotional responses?

There is a lot to talk about regarding the importance of maintaining a cool head when investing. Emotional responses can cloud judgment and lead to decisions that are not in line with an investor’s goals.

As stated earlier in this article, in traditional markets, one tool that is often used is market sentiment. This refers to the overall mood of the market and can give investors an idea of whether fear or greed is currently driving prices. Sentiment can be measured using surveys, news media analysis, and other methods. It should be highlighted that sentiment is only one piece of the puzzle; it is not always accurate and can change quickly.

Another way to manage emotions is to diversify your portfolio. This means investing in a mix of assets, including traditional and crypto markets. By spreading your risk across different asset classes, you can mitigate the impact of any one market on your overall portfolio. For example, your crypto holdings may still be valuable if the traditional stock market crashes. Diversification is a key part of managing risk and maintaining a well-balanced portfolio.

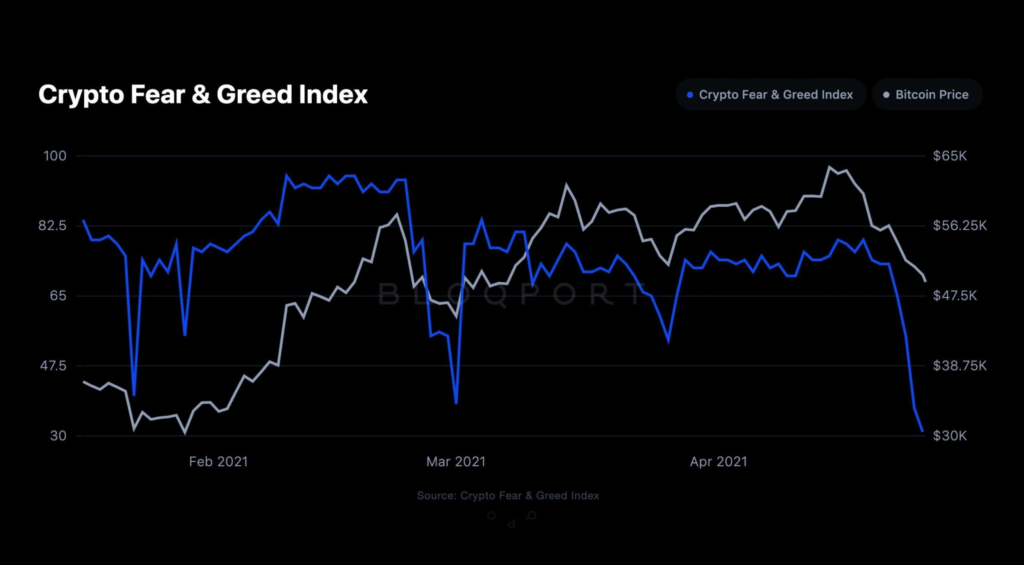

How can crypto sentiment be quantified?

To be added

Conclusion

Fear and greed are two of the most powerful emotions that drive human behavior. In the context of financial markets, these emotions can lead investors to make irrational investment decisions. However, investors can overcome these emotions by understanding how fear and greed work and making rational choices. Investors can use many strategies and tools to help manage their emotional responses. For institutional investors, Prometeo.ai indexes track fear and greed in financial markets. This lets investors stay informed about how these emotions impact market dynamics and make more informed investment decisions.